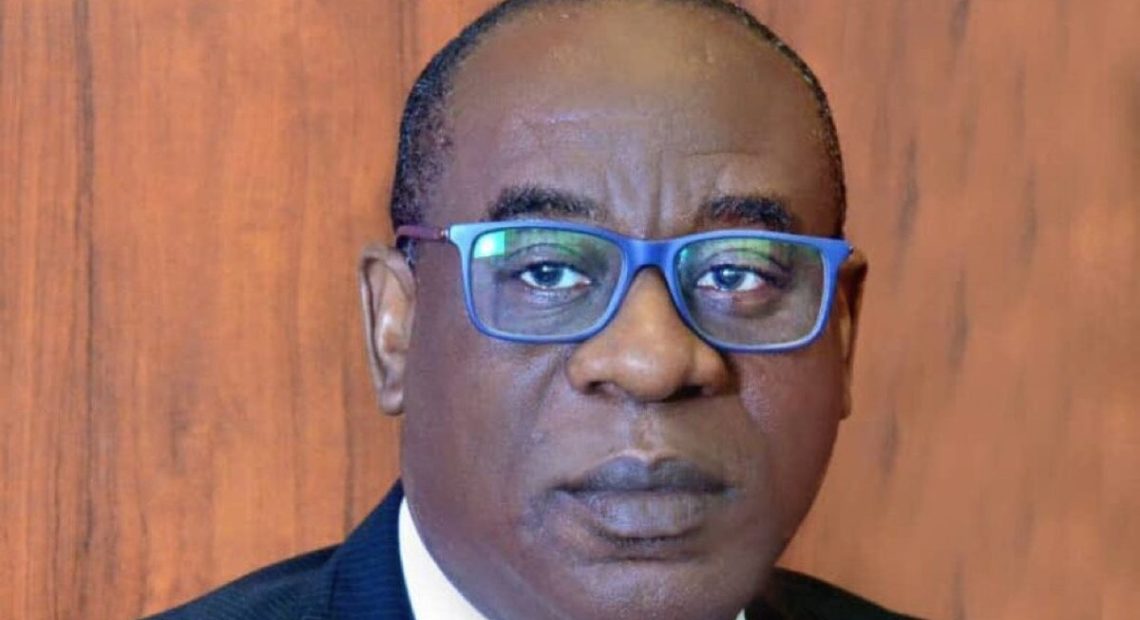

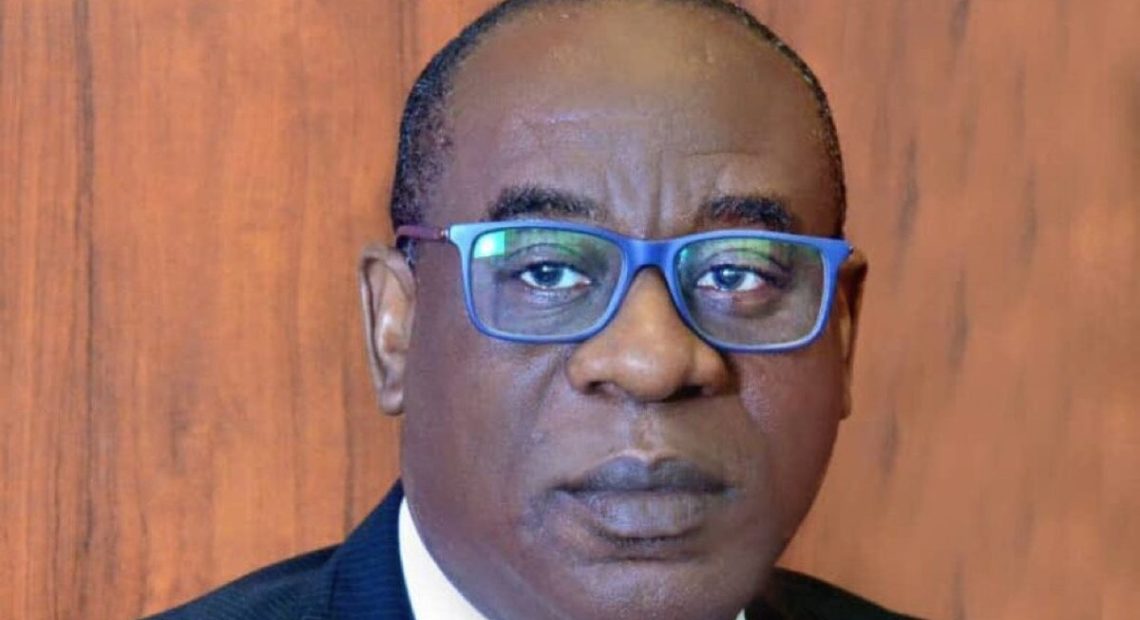

The new Governor of the Central Bank of Nigeria, Olayemi Cardoso, has said he will prioritise clearing the apex bank’s backlog of unsettled foreign exchange obligations in the near term.

He said this on Tuesday during the screening session of members of the Senate.

Cardoso promises to enhance transparency, fix corporate governance, and ensure confidence in the autonomy and integrity of the bank.

“We need to promptly find a way to take care of that. It would be naive for us to expect that we’ll be making too much progress if we’re not able to handle that side of the foreign exchange market,” he said.

The new CBN governor said he would maintain price stability, revert to evidence-based monetary policies, and discontinue his predecessor’s unorthodox monetary policies to bolster the country’s naira currency.

Cardoso’s screening as the nation grapples with falling economic indices with the naira nearing 1,000/$ at the parallel market.

The official market closed with the naira-to-dollar exchange rate settling at N755.08/$1 on Tuesday, according to the foreign exchange data released by the FMDQ Exchange

According to Cardoso, the immediate plan to stabilise the naira will be for the apex bank to settle existing financial obligations and make “transparent rules.”

Describing how to address what he termed as an ‘operational issue’, he said, “Right now, we have a situation where we are aware that there are unsettled obligations by the CBN. Whether it is $4bn, $5bn or $7bn, I don’t know but definitely the immediate priority will be to verify the authenticity and extent of what is owed.

“Number two, apart from the operational issue, there is one that is system related that involves ensuring that we come up with rules that are open, transparent that any of the players in that area understands. We can’t expect foreign investors and portfolio investors to come; we can’t expect them if there is no open, transparent system that everyone understands.

“In setting up those guidelines one will carry the relevant stakeholders along and the comment was made earlier that one should be ready to engage everybody and hear views. Those two things, though they may seem simple, will go a long way to easing up the restrictions we are having on people (investors) that want to come in.”

Also, the newly confirmed CBN governor said to tackle the country’s inflation, the CBN would roll out evidence-based policies.

He said, “When you look at the dimension of inflation, we will be doing evidence-based monetary policy. We shall not be making decisions based on a whim. We will significantly rebound the infrastructural demand with respect to ensuring that our data gathering capacity is enhanced so we can make decisions based on proper data.”

Cardoso during his screening emphasised the need to restore the apex bank’s independence and credibility by refocusing on its core mandate and ensuring a culture of compliance.

“Much has been made of past CBN forays into development financing such that the lines between monetary policy and fiscal intervention have become blurred.

“In refocusing the CBN to its core mandate, there is a need to pull the CBN back from direct development finance interventions into more limited advisory roles that support economic growth.”

As of October last year, about N9tn had been released as intervention funds by the apex bank.

The bank had said that about N3.7tn had been repaid by beneficiaries while over N5tn was not yet due for recovery.

For bank unhealthy bank charges, the international banker said that the team would review the situation and come up with the required position.

The newly confirmed governor also promised that he and his team would not be hijacked by politicians as they discharge their duties.

The CBN governor said, “It is important that we, who are considered for this position today, understand that this is a position of trust.

“With that comes a huge responsibility to meet up with that trust. I know that a lot of time and effort has gone into choosing the people who are standing here for nomination today.

“As far as I am concerned, under my leadership, we will not be hijacked by anybody. The idea is to ensure that we do what is right, when it is right, and how it is right. We’ve seen what the effect of not doing right has been, and we do not intend for that to be repeated.”

He added that his team and him would inculcate a culture of compliance into the apex bank by adhering strictly to the CBN Act 2007.

“I believe that the central bank under our watch will have no choice but to embrace a culture of compliance,” he said.

Punch/ Oluwayemisi Owonikoko

Subscribe to our Telegram and YouTubeChannels also join our Whatsapp Update Group